Counterpoint Research says that Samsung’s 19-year stretch at the top of the global premium TV market is coming under threat as rivals Hisense and TCL continue to make rapid gains in both revenue and shipments.

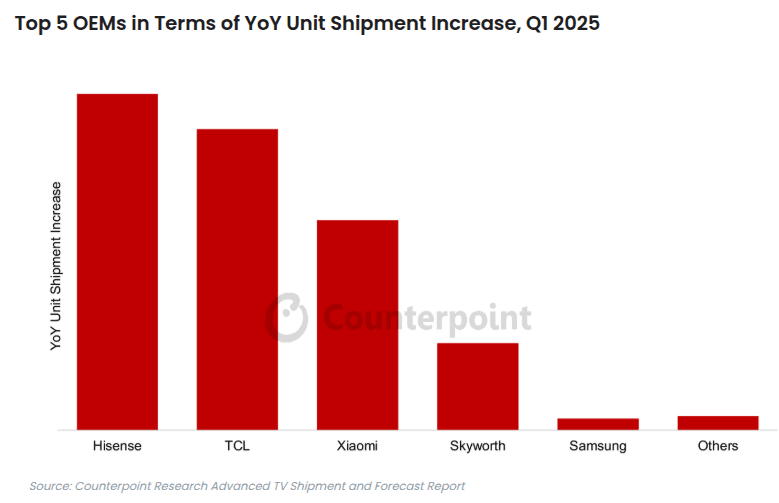

Its latest report, which covers the first quarter of 2025, found that Hisense and TCL increased their sales revenues by a mammoth 87% and 74% respectively, boosting their share of the market in terms of TV shipments. Hisense now accounts for 20% of all global premium TV shipments, up from 14% one year earlier, while TCL now claims a 19% market share, up from 13% the year before.

In terms of revenue share, Hisense now commands 17% of the market, up from 13%, while TCL stands at 16%, up from 13%’ one year ago.

Curiously, the report didn’t give any exact numbers regarding Samsung or LG, which have long dominated the premium TV segment. LG lost its spot as the number two TV manufacturer last year, and it seems clear from Hisense’s and TCL’s rapid growth that Samsung is now at risk of losing its status as the top dog, having held onto that position for 19 long years. Indeed, Hisense said last November that this is its intention, and plans to try and unseat Samsung in the U.S. market first before claiming the global top spot.

Meanwhile, there’s a chance that LG could slip further behind, as Counterpoint says that two more Chinese TV brands –Xiaomi and Skyworth – have also made strong gains in the last year. Samsung's growth was barely a blip, and LG didn't even register.

“Those gains came largely at the expense of the two South Korean giants,” Counterpoint said in a press release.

It’s thought that one of the reasons for Samsung’s weakened grip on the premium TV market is its decision to shift its focus away from Mini-LED TVs to embrace OLED. The company led the Mini-LED TV industry in sales until 2023, the year it finally launched its first OLED models, and consequently fell behind TCL in 2024. More recently, it has also been surpassed by Hisense and Xiaomi in Mini-LED, thanks partly to the strong growth of premium TV sales in China.

Samsung, meanwhile, sold more OLED TVs than Mini-LED models for the first time last year. While it still makes high-end Neo QLED models with Mini-LED displays, it positions its OLED models as the more premium products. However, the Chinese brands, which are much less focused on OLED, still undercut its Mini-LED TV prices, boosting their appeal.

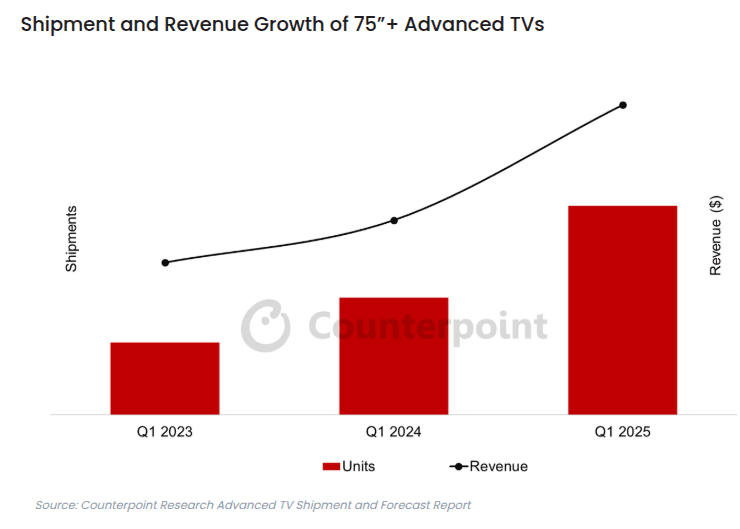

Besides Samsung’s lower emphasis on Mini-LED, another factor driving growth for the Chinese TV brands is the trend towards bigger televisions. These days, consumers feel that bigger is better, and Hisense and TCL are accommodating them with lower-cost 75-inch-plus models. In contrast, OLED TVs still tend to carry higher prices, especially the larger models.

In the last year, shipments of premium TVs in the segment grew 79%, while revenue rose 59% over the same period. While large-sized OLED TVs are getting cheaper, especially for 77-inch and 83-inch models, they are unable to match Mini-LED in the affordability stakes.

"MiniLED TVs typically compete at price points similar to OLED TVs, but because of the cost difference between OLED and LCD TV panels, consumers face a choice between a smaller OLED TV or a larger MiniLED TV," said Counterpoint analyst Bob O'Brien. "An increasing number of consumers are choosing MiniLEDs."